In the bustling landscape of Nigerian fintech, PalmPay has emerged as a formidable player, revolutionizing digital payments and financial services. Launched in 2019, the startup has swiftly climbed the ranks, boasting 35 million registered users and a million small-to-medium business clients.

Strategic Growth and Investment:

PalmPay’s rapid ascent can be attributed to its strategic partnerships and significant funding. With a $40 million seed round led by Chinese mobile phone manufacturer Transsion, and a subsequent $100 million funding round, PalmPay has secured its position as one of Nigeria’s leading fintechs.

User-Centric Approach:

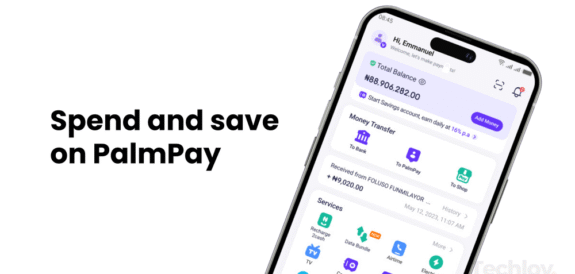

Focusing on the underserved population, PalmPay offers services like bill payments, mobile airtime top-ups, and instant bank transfers. Its “smartphone first” strategy, complemented by pre-installation on Transsion’s Tecno, Itel, and Infinix phones, has significantly boosted user adoption.

Compliance and Expansion:

Maintaining robust “know your customer” protocols, PalmPay ensures secure transactions while expanding its services. The company has ventured into Tanzania, Bangladesh, Ghana, and South Africa, aiming to become a comprehensive financial super app by offering loans and insurance through partnerships.

Localized Success:

PalmPay’s success lies in its deep understanding of the Nigerian market. By addressing the needs of those excluded by traditional banks, it has facilitated a shift from cash to digital transactions, making financial services more accessible and rewarding.

Conclusion:

PalmPay’s journey underscores the potential of fintech in driving financial inclusion and digital transformation in Nigeria. As it continues to innovate and expand, PalmPay sets a precedent for how localized strategies can lead to global success.

Source: Financial Times